Source: Oriental Fortune Network

Recently, Luxshare Precision, known for its foundry for Apple's AirPods, announced that it will wholly acquire two wholly-owned subsidiaries of Wistron for RMB 3.3 billion. It is expected to complete the transaction before the end of this year. After the completion of this transaction, Luxshare Precision will become Apple's first foundry in mainland China, and the iPhone foundry team will usher in fresh blood.

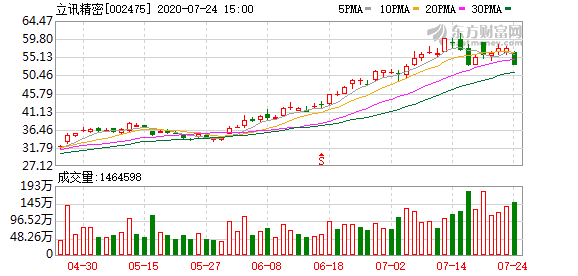

As a consumer electronic components ODM company, Luxshare Precision may not be familiar to ordinary consumers. But in the secondary market, Luxshare Precision is a potential stock like a "dark horse". Since its listing in 2010, Luxshare Precision's stock price has risen steadily, and the company's current market value has reached 385.2 billion yuan. What kind of development path does Luxshare Precision have been favored by Apple? What changes will happen to the foundry pattern of Apple mobile phones? What benefits can Apple get from it?

The relationship between Luxshare and Apple

Luxshare Precision was born in 2004. It was initially engaged in the production and sales of connectors for computers and peripherals, and it was a single component manufacturer. After obtaining the main supplier status of Lenovo, Tongfang, and Founder, Luxshare Precision began to accept Foxconn’s domestic orders, and its performance immediately grew rapidly. In 2010, Luxshare Precision was successfully listed on the Shenzhen Stock Exchange. This year, the company achieved operating income of 1.011 billion yuan and net profit of 116 million yuan.

Since 2011, Luxshare Precision has successively acquired shares of Kunshan Liantao Electronics Co., Ltd., which was also one of the main suppliers of Apple's cable. The acquisition of Kunshan Liantao allowed Luxshare Precision to enter Apple's supply chain smoothly. Since then, Luxshare Precision has gradually won Apple’s approval and successively won key orders for iPad internal cables, MacBook power cords, Apple Wacth wireless charging/straps, MacBookType-C and iPhone adapters.

In 2017, Luxshare Precision won the foundry qualification of Apple's wireless headset AirPods. With this cooperation with Apple, Luxshare Precision achieved a substantial increase in company performance and revenue in 2018, and its market value in 2019 has also become the leader of the "small and medium board".

In fact, Apple’s AirPods were originally manufactured exclusively by Taiwanese ODM manufacturer Inventec, but Inventec has been troubled by the overall yield index. OEMs need sophisticated craftsmanship and strong precision manufacturing capabilities. In 2017, Apple began to hand over some orders to Luxshare Precision for production. Facts have proved that this choice of Apple has achieved unexpected results. After Luxshare's closely integrated AirPods products, the overall yield rate has reached a very high level and an excellent delivery level has been guaranteed. In 2019, Apple's new noise-cancelling Bluetooth headset AirPods Pro began to be 100% manufactured by Luxshare Precision.

The excellent foundry performance of AirPods products is a stepping stone for Luxshare Precision, and Luxshare has therefore become one of the best performing companies in the Asian stock market in 2019. At present, the market value of Luxshare Precision has reached nearly 400 billion yuan, which is much higher than the market value of about 280 billion yuan for the Foxconn parent company of another iPhone OEM.

According to data, consumer electronics accounted for 83.16% of Luxshare Precision's total revenue, and Apple is the largest "buyer" of Luxshare's precision consumer electronics business. Zhao Yan, director of the Consumer Electronics Industry Research Office of the Institute of Electronic Information Industry of CCID Think Tank, said in an interview with a reporter from China Electronics News that the consumer electronics market has continued to cool in recent years. There are several traditional products such as mobile phones, tablets, PCs and TVs. The growth peaked, and the demand for new forms of consumer electronic products such as Bluetooth headsets, smart bracelets, and smart speakers increased. With the explosion of demand for TWS wireless headsets based on AirPods, the market value of Luxshare Precision, which is deeply tied to the foundry of AirPods and other products, has continued to rise.

The relationship between Luxshare and Apple

Luxshare Precision was born in 2004. It was initially engaged in the production and sales of connectors for computers and peripherals, and it was a single component manufacturer. After obtaining the main supplier status of Lenovo, Tongfang, and Founder, Luxshare Precision began to accept Foxconn’s domestic orders, and its performance immediately grew rapidly. In 2010, Luxshare Precision was successfully listed on the Shenzhen Stock Exchange. This year, the company achieved operating income of 1.011 billion yuan and net profit of 116 million yuan.

Since 2011, Luxshare Precision has successively acquired shares of Kunshan Liantao Electronics Co., Ltd., which was also one of the main suppliers of Apple's cable. The acquisition of Kunshan Liantao allowed Luxshare Precision to enter Apple's supply chain smoothly. Since then, Luxshare Precision has gradually won Apple’s approval and successively won key orders for iPad internal cables, MacBook power cords, Apple Wacth wireless charging/straps, MacBookType-C and iPhone adapters.

In 2017, Luxshare Precision won the foundry qualification of Apple's wireless headset AirPods. With this cooperation with Apple, Luxshare Precision achieved a substantial increase in company performance and revenue in 2018, and its market value in 2019 has also become the leader of the "small and medium board".

In fact, Apple’s AirPods were originally manufactured exclusively by Taiwanese ODM manufacturer Inventec, but Inventec has been troubled by the overall yield index. OEMs need sophisticated craftsmanship and strong precision manufacturing capabilities. In 2017, Apple began to hand over some orders to Luxshare Precision for production. Facts have proved that this choice of Apple has achieved unexpected results. After Luxshare's closely integrated AirPods products, the overall yield rate has reached a very high level and an excellent delivery level has been guaranteed. In 2019, Apple's new noise-cancelling Bluetooth headset AirPods Pro began to be 100% manufactured by Luxshare Precision.

The excellent foundry performance of AirPods products is a stepping stone for Luxshare Precision, and Luxshare has therefore become one of the best performing companies in the Asian stock market in 2019. At present, the market value of Luxshare Precision has reached nearly 400 billion yuan, which is much higher than the market value of about 280 billion yuan for the Foxconn parent company of another iPhone OEM.

According to data, consumer electronics accounted for 83.16% of Luxshare Precision's total revenue, and Apple is the largest "buyer" of Luxshare's precision consumer electronics business. Zhao Yan, director of the Consumer Electronics Industry Research Office of the Institute of Electronic Information Industry of CCID Think Tank, said in an interview with a reporter from China Electronics News that the consumer electronics market has continued to cool in recent years. There are several traditional products such as mobile phones, tablets, PCs and TVs. The growth peaked, and the demand for new forms of consumer electronic products such as Bluetooth headsets, smart bracelets, and smart speakers increased. With the explosion of demand for TWS wireless headsets based on AirPods, the market value of Luxshare Precision, which is deeply tied to the foundry of AirPods and other products, has continued to rise.

The relationship between Luxshare and Apple

Luxshare Precision was born in 2004. It was initially engaged in the production and sales of connectors for computers and peripherals, and it was a single component manufacturer. After obtaining the main supplier status of Lenovo, Tongfang, and Founder, Luxshare Precision began to accept Foxconn’s domestic orders, and its performance immediately grew rapidly. In 2010, Luxshare Precision was successfully listed on the Shenzhen Stock Exchange. This year, the company achieved operating income of 1.011 billion yuan and net profit of 116 million yuan.

Since 2011, Luxshare Precision has successively acquired shares of Kunshan Liantao Electronics Co., Ltd., which was also one of the main suppliers of Apple's cable. The acquisition of Kunshan Liantao allowed Luxshare Precision to enter Apple's supply chain smoothly. Since then, Luxshare Precision has gradually won Apple’s approval and successively won key orders for iPad internal cables, MacBook power cords, Apple Wacth wireless charging/straps, MacBookType-C and iPhone adapters.

In 2017, Luxshare Precision won the foundry qualification of Apple's wireless headset AirPods. With this cooperation with Apple, Luxshare Precision achieved a substantial increase in company performance and revenue in 2018, and its market value in 2019 has also become the leader of the "small and medium board".

In fact, Apple’s AirPods were originally manufactured exclusively by Taiwanese ODM manufacturer Inventec, but Inventec has been troubled by the overall yield index. OEMs need sophisticated craftsmanship and strong precision manufacturing capabilities. In 2017, Apple began to hand over some orders to Luxshare Precision for production. Facts have proved that this choice of Apple has achieved unexpected results. After Luxshare's closely integrated AirPods products, the overall yield rate has reached a very high level and an excellent delivery level has been guaranteed. In 2019, Apple's new noise-cancelling Bluetooth headset AirPods Pro began to be 100% manufactured by Luxshare Precision.

The excellent foundry performance of AirPods products is a stepping stone for Luxshare Precision, and Luxshare has therefore become one of the best performing companies in the Asian stock market in 2019. At present, the market value of Luxshare Precision has reached nearly 400 billion yuan, which is much higher than the market value of about 280 billion yuan for the Foxconn parent company of another iPhone OEM.

According to data, consumer electronics accounted for 83.16% of Luxshare Precision's total revenue, and Apple is the largest "buyer" of Luxshare's precision consumer electronics business. Zhao Yan, director of the Consumer Electronics Industry Research Office of the Institute of Electronic Information Industry of CCID Think Tank, said in an interview with a reporter from China Electronics News that the consumer electronics market has continued to cool in recent years. There are several traditional products such as mobile phones, tablets, PCs and TVs. The growth peaked, and the demand for new forms of consumer electronic products such as Bluetooth headsets, smart bracelets, and smart speakers increased. With the explosion of demand for TWS wireless headsets based on AirPods, the market value of Luxshare Precision, which is deeply tied to the foundry of AirPods and other products, has continued to rise.

Apple's abacus

In 2017, Apple CEO Cook made a special trip to visit Luxshare Precision's Kunshan factory and gave the company a high degree of praise. Luxshare Precision stated in the announcement: Based on the company's deep accumulation in the consumer electronics field over the years and the medium and long-term strategic layout of the consumer electronics business, the merger is in line with the company's sustainable development plan.

So, what are the advantages of Luxshare Precision in the consumer electronics business that make it stand out among Apple's many foundries? Zhao Yan told reporters that Luxshare attaches great importance to R&D investment in new technologies and its investment is increasing year by year. In 2018, R&D expenses were 2.515 billion yuan, and in 2019, R&D expenses increased to 4.376 billion yuan, accounting for about 7% of operating income. It is a leader in the precision manufacturing process industry and has a high product yield. In addition to Kunshan, Luxshare has also established advanced R&D production technology and manufacturing process platforms in Dongguan, Taiwan, and the United States. In addition, Luxshare has continued to expand through mergers and acquisitions. Vertical business areas (from connectors to communications, automotive electronics and acoustics).

The reporter was informed that foreign countries were not surprised by the acquisition news. They generally believed that Apple had been encouraging Lixun to invest in order to reduce Apple's dependence on Foxconn's iPhone assembly business.

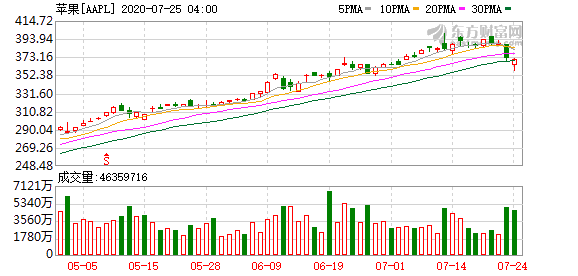

Data shows that Foxconn currently accounts for more than 50% of iPhone production, and before the acquisition, Wistron’s latest share in the iPhone foundry market has been less than 5%. In an interview with China Electronics News, Lisa, a retail analyst at RUNTO IOT, a technology industry research agency, said that there are roughly three reasons for supporting Luxshare's leadership: one is Apple's demand for supplier diversification; the other is Apple wants to further encourage fierce competition among suppliers, so as to enhance Apple's own bargaining power, reduce costs and increase gross profit; third, there may be a crisis of trust in the supply chain and delivery capabilities of companies such as Foxconn. The overall Taiwan-funded assembly plants have gradually regressed in recent years in new product research and development, investment willingness and cooperation efficiency, and Foxconn's recent days have not been difficult-withdrawing from China, and suffering a business blow after building a factory in India. For Apple, Foxconn’s uncertainty will have a certain impact on its product yield.

In fact, Apple's support for Luxshare Precision is much better than this. In May of this year, news broke out in the industry that Apple suggested that Luxshare Precision should make a major investment in Catcher Technology, a company that provides metal cases for iPhone and Macbook. Luxshare Precision has been in talks with Catcher Technology for more than a year. For a long time, it has now entered a more in-depth negotiation stage. If the two parties reach an agreement, Luxshare Precision will be able to produce high-quality metal cases, and at the same time obtain intellectual mobile phone assembly knowledge copyright, is expected to become the "second" Foxconn. The reporter has contacted Catcher Technology many times, but has not received a response as of the time of publication.

Analyst Lisa told reporters that before Wistron was OEM for the old iPhone models, and Luxshare Precision will continue Wistron’s OEM business for traditional models after taking over Wistron’s business. However, from the standpoint of Luxshare Precision, it wants to further deepen Apple's entire product supply chain, and strive to cut into the foundry share of new iPhone models, to open up the precision manufacturing platform and extend to the entire category. However, according to Apple's supply chain review rhythm, it is predicted that Luxshare will find it difficult to make a breakthrough in new models in 2021.

Post time: Aug-01-2020